What Does IME Mean in Pennsylvania Workers’ Compensation?

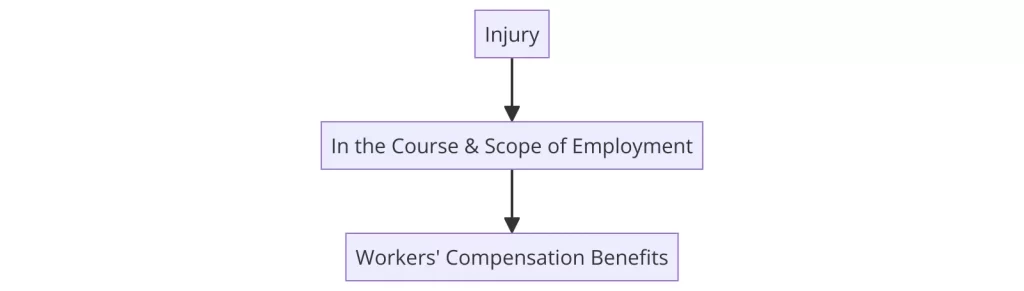

You suffer a workplace injury in Pennsylvania. You file a workers’ compensation claim and maybe start receiving benefits. Then the insurance company schedules an Independent Medical Examination — or IME. Many web searches show confusion about an IME meaning in PA.

This guide explains exactly what an IME means, why the insurer forces you to attend one, and how you protect your benefits. At McMenamin & Wing, we work on Pennsylvania workers’ compensation cases every day. We help injured workers manage IMEs and get the money they deserve.

What Does IME Stand For — Is It “Independent”?

IME stands for Independent Medical Examination (sometimes called Independent Medical Evaluation).

The insurance company picks a doctor and pays that doctor to examine you. The insurer wants the doctor’s opinion on:

- Whether your injury relates to your job

- If you recovered enough to return to work

- Whether you need ongoing medical treatment

- How much disability you still have

In reality, the doctor works for the insurance company — not you. Many Pennsylvania workers’ compensation lawyers call these “Defense Medical Exams” because the doctor rarely stays truly neutral. The insurer chooses physicians who often find ways to reduce or end benefits.

Pennsylvania law allows the insurance company to require an IME at reasonable times. Generally this usually means up to twice per year (every six months).

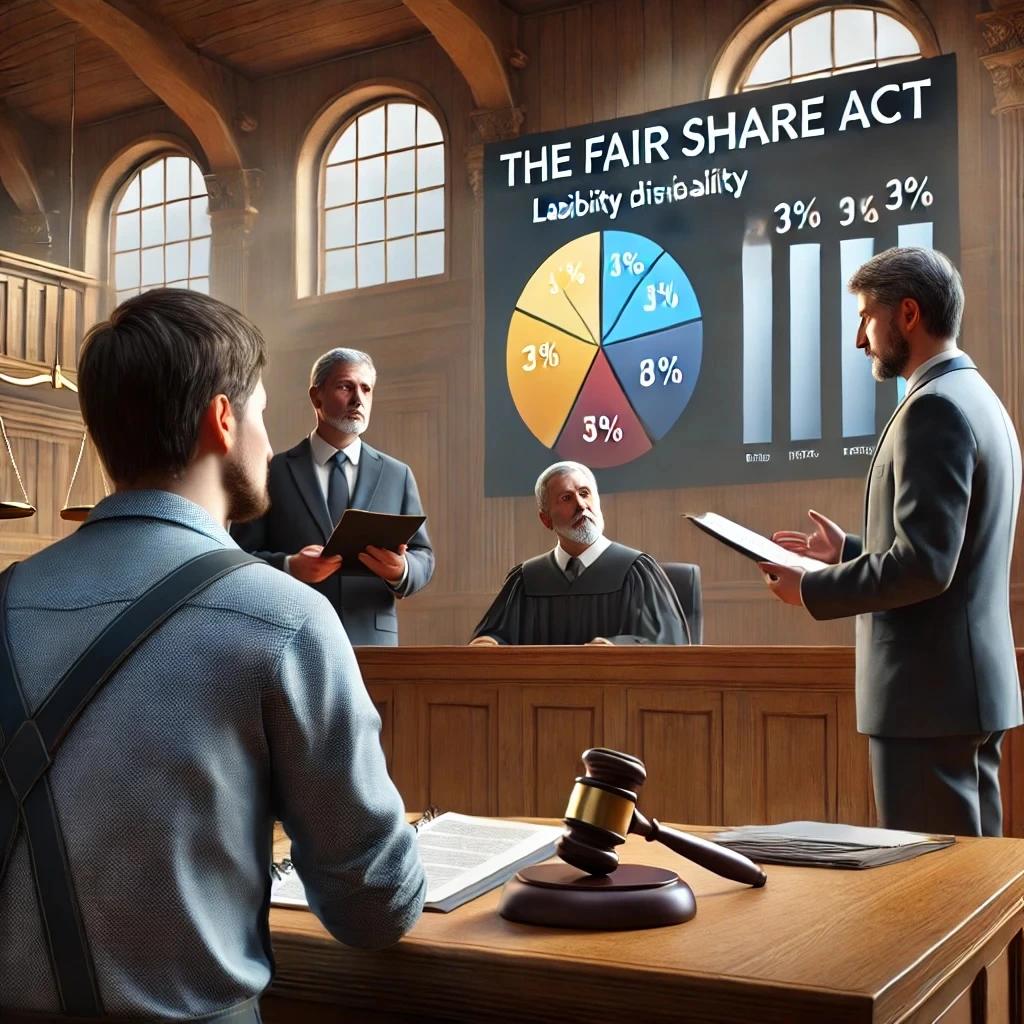

IME vs. IRE: Know the Difference in 2025

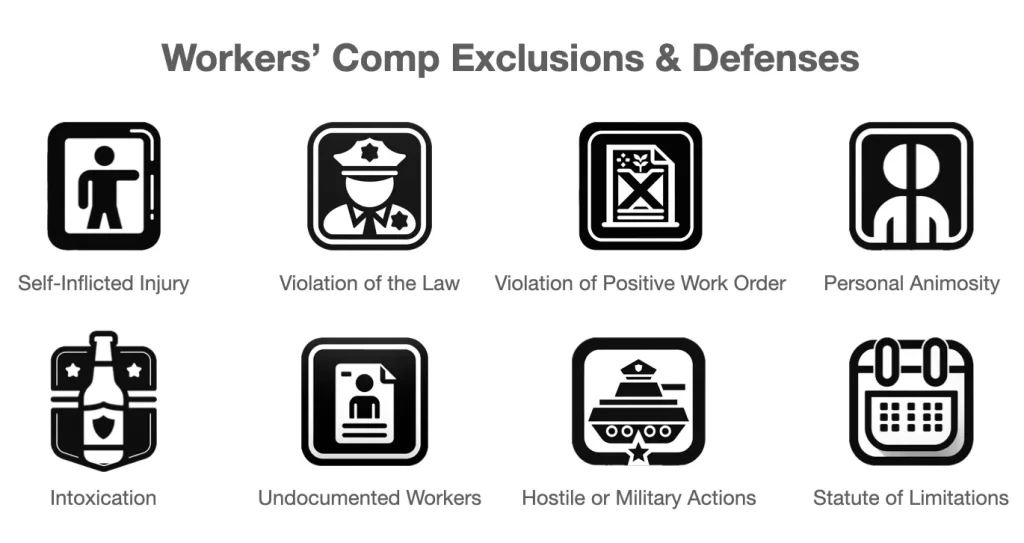

People confuse IME with IRE. They differ completely:

- IME: insurer uses this to check your current status and gather evidence against your claim.

- IRE (Impairment Rating Evaluation): The insurer requests this only after you receive 104 weeks total disability benefits. The doctor assigns a permanent impairment percentage using the AMA Guides (6th Edition). If the rating falls below 35%, employer may attempt to modify benefits to partial disability (max 500 weeks total).

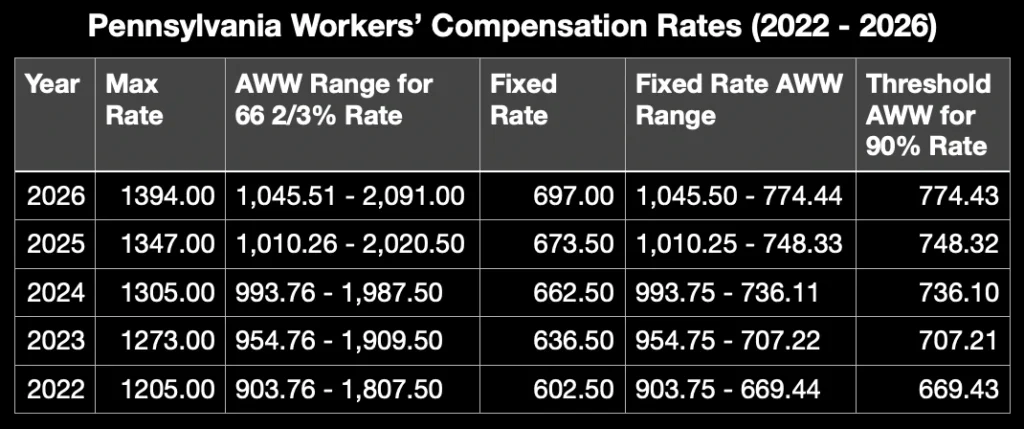

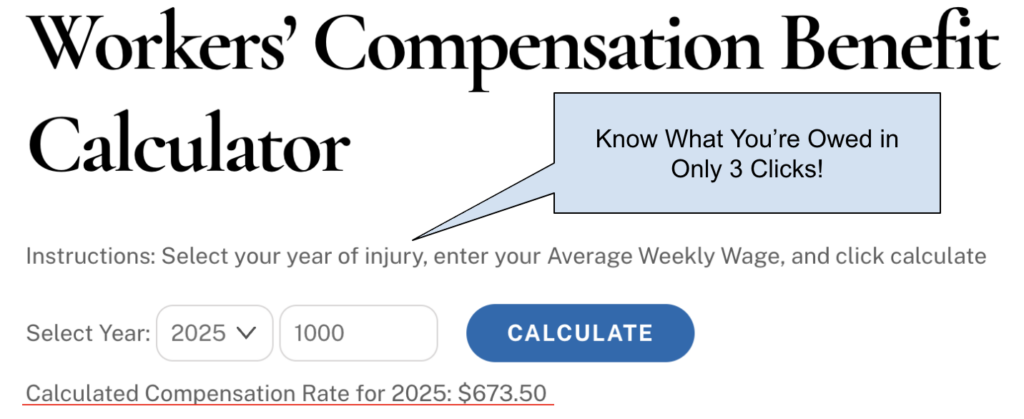

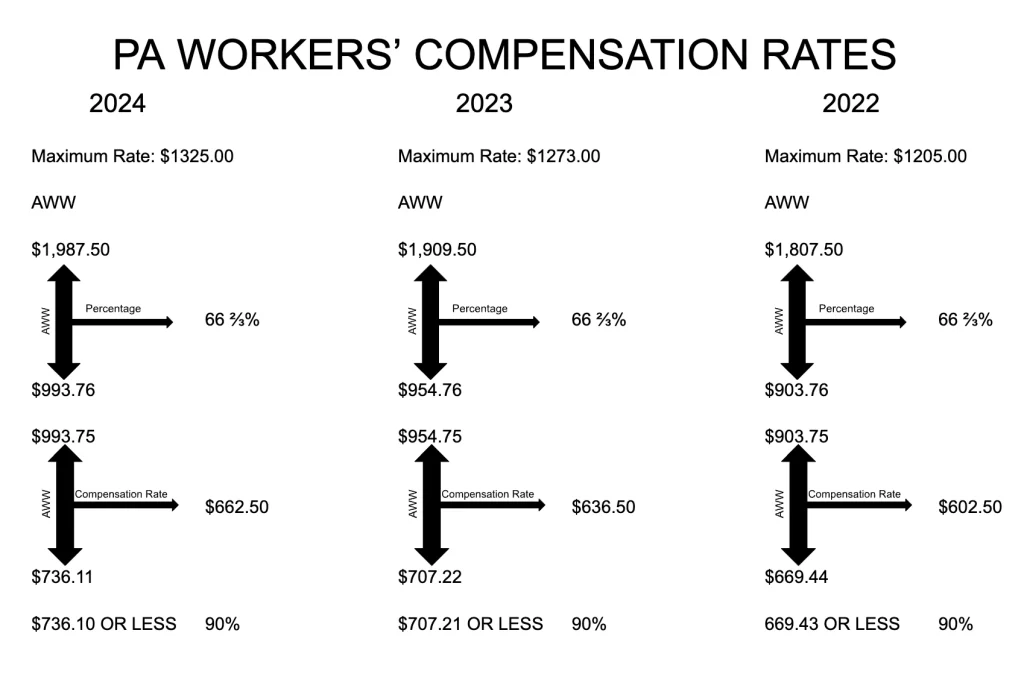

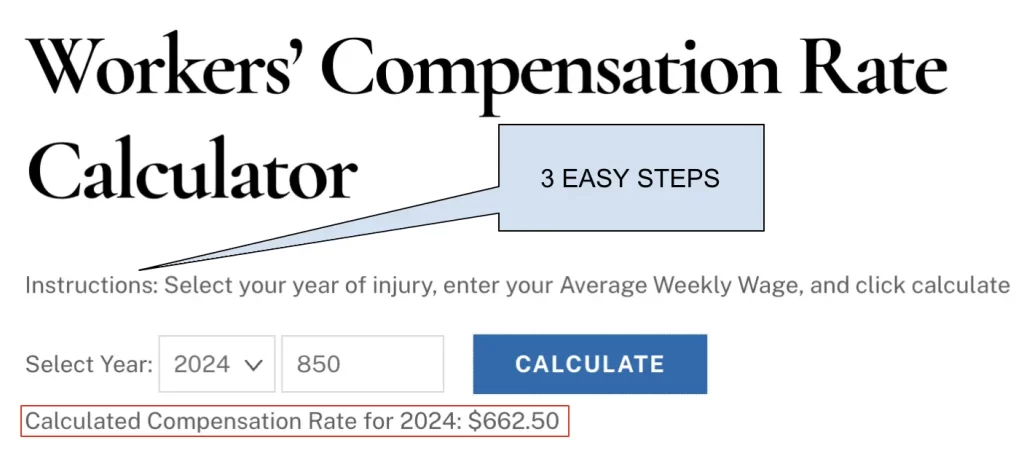

No major changes hit IME rules in 2026, but the maximum compensation rate rose to $1,394 per week for new injuries. IRE rules have remained the same after updates a few years ago.

What Happens During a Pennsylvania IME?

When you arrive at the independent medical exam, expect:

- The doctor usually reviews your medical records beforehand.

- You fill out forms about your pain, daily activities, and how the injury happened.

- The doctor or nurse tells you the purpose of the exam and the lack of a doctor patient relationship.

- The doctor asks detailed questions (medical history) — often trying to catch changes in your story, treatment, or medical condition.

- You undergo a quick physical examination (usually less than 10-20 minutes).

- The doctor writes a report and sends it to the insurance company.

The exam provides no treatment. We generally tell clients to ignore any “advice” the doctor gives — follow only your treating doctor’s orders.

Insurance companies sometimes hire private investigators to film you arriving or leaving. Act normally, but avoid heavy lifting or activities that exaggerate your abilities. Insurers use this evidence to undercut disability claims or even to deny an injury occurred.

How to Prepare for Your IME and Protect Your Benefits

Usually, an once an insured employer, TPA, or other party requests an IME, the worker must attend. Skip it without a good reason, and the insurer may suspend your workers’ compensation benefits.

Follow these steps to prepare to undergo an IME:

- Bring a list of your current medications and symptoms.

- Describe your pain and limitations honestly and consistently — match what you told your own doctors.

- Answer questions directly, but keep responses short.

- Avoid volunteering extra information or joking around.

- If something during the exam causes pain or discomfort, speak up. The doctor may not ask or tell you what they are evaluating.

- Request a copy of any letter the insurer sent the doctor (they don’t have to give it, but ask anyway).

- Ask the insurance company for transportation if you need it. Pennsylvania law says they must pay for mileage or give you a ride.

- You have the right to bring a healthcare provider with you, such as a nurse, to observe the examination.

Most importantly: Call an experienced Pennsylvania workers’ comp attorney before you go. We review what to expect, help you practice answers, and fight unfair reports.

What Happens After the IME?

The doctor sends a report to the insurer (you get a copy eventually). Then:

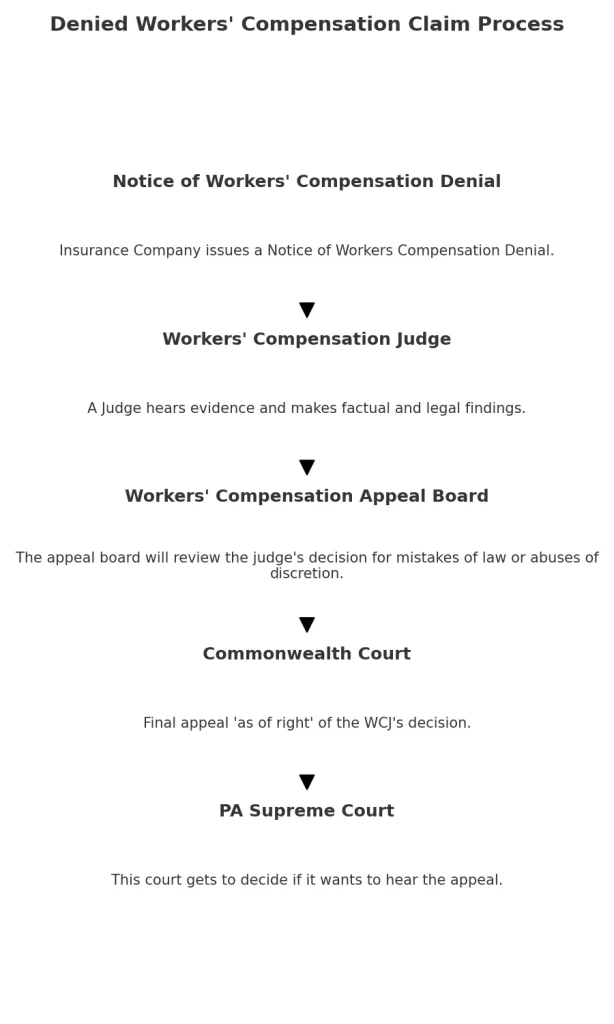

- The insurer accepts the report and files a petition to stop, suspend, or modify your benefits.

- You challenge the report with evidence from your treating doctors.

- A workers’ compensation judge decides who to believe.

Judges often side with treating physicians over IME doctors, especially when your doctor knows your case for months or years.

Don’t Face an IME Alone — Get Help Now

Insurance companies schedule IMEs when they want to cut your benefits. You fight back effectively with the right preparation and representation.

At McMenamin & Wing, we level the playing field. We helped thousands of Pennsylvania workers keep their benefits after bad IME reports.

Call us today at (215) 609-4183 or fill out our free case evaluation form. We offer free consultations, and you pay nothing unless we win more money for you.

You earned your workers’ comp benefits through hard work. Protect them and reach out today 215-609-4183.