PA Workers’ Comp Employment Relationships

Pennsylvania Employment Relationships and Workers' Comp

In PA, the Workers’ Compensation Act covers employees for work related injuries and illnesses. It mandates that employers must provide workers’ compensation insurance for their employees. If you have suffered a work injury, your employer may be liable for workers’ compensation. Keep in mind, employers often misclassify workers.

We hope to make things clear for injured workers and employers in PA. We will cover who qualifies for benefits and how the law views different job roles.

Employee or Independent Contractor?

Hiring Power

Employers typically have a greater control over selecting employees than independent contractors.

Ability to Fire

Employers may have more discretion in the removal of an employee than an independent contractor.

Control Over Work

Employees can have more oversight and direction as to how to complete job tasks and perform their jobs. An employer also more likely supplies the tools needed for the job for an employee. An independent contractor may purchase their own supplies.

Overall Control

Employers usually manage an employee’s hours worked and methods of production. Independent contractors typically decide when and how they will do the job.

Employees and independent contractors may also differ in wages and benefits. Employees may get a steady wage, while contractors do not. Employee may also have benefits, not typically provided for independent contractors.

This case gives more information: Universal Am-Can, Ltd. v. WCAB

Special Rules for Construction Workers

Construction workers and general contractors have specific rules. The Construction Workplace Misclassification Act (Act 72), protects workers in specific industries after a work injury.

@thwesq Worker misclassification is a nationwide problem, but I see it all the time in Workers’ Compensation cases here in Pennsylvania. #greenscreen #lawyer #employees #workersrights #constructionworker #construction ♬ original sound – Tom Wing

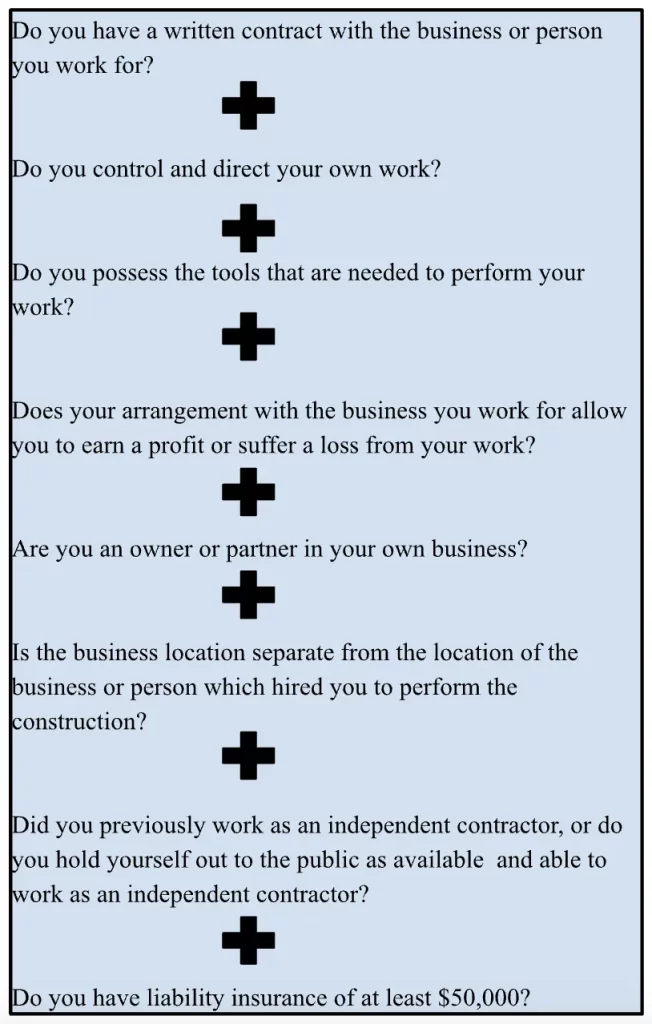

What Makes You an Independent Contractor in Construction?

A Written Contract

You have a written agreement for the work you perform.

Freedom in Your Work

You have the ability to do your job without your employer telling you how you do it.

Running Your Own Business

You operate a business separate from the person who hired you.

If you answer “yes” to all questions below:

The Statutory Employer

Someone other than the original employer might be held liable for workers’ comp benefits. Common in construction, when working through subcontractors. This can make you the statutory employee for workers’ comp, even if that employer did not withhold income taxes.

The following case introduced the McDonald Test, which helps identify a statutory employer: McDonald v. Levinson Steel Co.

Am I a Borrowed Employee?

Sometimes, your job might send you to work for another company. This can make things confusing after an on-the-job injury. Let’s break down what happens with workers’ compensation when you’re a “borrowed employee” in Pennsylvania.

Imagine you usually work for ABC Staffing. ABC Staffing sends you to work for XYZ Logistics Company as a packer. ABC Staffing pays your wages, but you work under XYZ Logistic Company’s control as a loaned employee.

This situation makes you a borrowed employee, also called a borrowed servant. If you suffer an injury while working for XYZ Logistics Company, who covers the lost wages and medical bills? The law looks at the amount of control each employer had over you at the time of your injury.

Employer control

XYZ controlled the work you performed and how it happened. Generally, the company that controlled your work at the time of injury must pay workers’ compensation benefits. Many times, the staffing company will pay for the medical care and lost wages owed and not the borrowing employer. This setup helps ensure coverage for work injuries, no matter where you work.

The following case gives an overview of this kind of employment with a staffing company: JFC Temps, Inc. v. WCAB.

Who Does Not Qualify for Workers’ Comp?

Casual Workers

Sporadic work, not central to the business, may not have coverage.

Domestic Workers

Usually covered only if the employer opts in for coverage.

Agricultural Workers

Certain conditions, like earnings or days worked, determine their coverage.

Final Thoughts

Workers’ compensation is a unique area of the law. Not a common law area, instead centered around the Workers’ Comp Act.

Complex employment relationships can make workers’ comp confusing. Knowing the rules for different employee relationships and construction workers, can help make sense of it. This knowledge can protect your right to receive benefits for injuries and illnesses at work.

Seeking advice from a lawyer can ensure you protect your rights. If you have questions about qualifying for workers’ comp, let us know. Reach out to our offices 24/7 for a free consult (215) 609-4183.