PA Workers’ Compensation Settlement Calculator

Workers' Comp Settlement Calculator

PA Workers’ Comp Settlement Value – Updated For 2026

Going through a work-related injury requires an understanding of your rights and potential benefits. After a work injury, so many unknowns exist, including when you can physically return to work. This leads to many financial worries. Getting an idea of the value of your case may help to relieve some of this stress.

@thwesq Replying to @Tik Tok settlement value for a workers comp claim involves balancing the different risks and potential benefits and injured worker is likely to receive #workerscomp #workerscompensation #settlement #lawyertok ♬ OK – Flight School & Zai1k

The PA Workers’ Comp Settlement Calculator helps injured workers estimate the value of their claims. Here, we will explain the calculator’s role in determining workers’ compensation benefits.

Disability Ratings

Total Disability

Total disability benefits offer help for employees completely unable to work because of their injuries. They provide a steady income during recovery by using the average weekly wage to calculate the benefits owed.

Keep in mind, received compensation never exceeds the statewide average weekly wages for the year of injury. The maximum weekly compensation rate changes each year. The Pennsylvania Department of Labor calculates this number. For more information on that, you can read our guide on wage loss benefits.

Partial Disability

For a partially disabling injury, partial disability benefits provide income to make up the gap in lost wages. This helps workers that can work some, but not as much as they did pre-injury. The wage loss benefits correspond to their reduced earning capacity. Injured workers receive two-thirds of the wage loss in benefits for the partial disability.

Specific Loss

Injuries that result in permanent loss of use may qualify for specific loss benefits. These benefits compensate for an amputation or complete loss of use of a body part. Whether it is the loss of a limb or of a sensory function, the law determines the number of weeks of compensation owed.

The only exception to this rule is any disfigurement of the head, face, or neck. In this case, a workers’ comp judge awards the compensation.

Impairment Rating

After an injured worker has received 104 weeks of benefits, they may undergo an impairment rating evaluation. Done by a designated impairment rating evaluator selected by the Bureau, this evaluation provides an impairment rating score.

If your impairment rating comes in below 35%, your benefits will convert to partial disability. Partial disability benefits max out at 500 weeks. This caps the total risk to the insurance company, potentially limiting the value of your claim.

If the rating comes back at 35% or above, your benefits will not convert to partial disability. Total disability benefits have the potential to remain payable for a lifetime.

Medical Expenses

Workers’ compensation provides for full coverage of the medical treatment costs incurred because of the work-related injuries. Workers’ comp insurance pays for medical costs, so injured employees can recover without financial worries. Always think about future medical costs when considering a settlement.

Workers Comp Settlement Calculator

Settlement Estimates

This work injury settlement calculator helps injured workers estimate the value of their claims. It considers general medical expenses, the average weekly wage, disability level, and historic settlement results. This estimate can give a basic starting point to chat with your lawyer about.

A calculator cannot replace a skilled workers’ comp lawyer. Only a lawyer can analyze all the unique details of your case.

Workers’ Comp Lawyers

Valuing a workers’ compensation claim requires legal knowledge. Workers’ comp lawyers are vital in giving guidance to make sure your settlement accurately reflects your claim’s value.

They have a deep understanding of the PA workers’ compensation rate schedule. As well as the labor and industry regulations. A skilled workers’ comp attorney will also know the system, including any risks you face as your claim moves through the process. This makes them key in getting the maximum compensation for injured workers.

The More You Know

Knowing how to calculate workers’ comp benefits can help you to figure out wage loss and medical expenses. By having this knowledge, you can make more informed choices.

The workers’ comp rate schedule and Pennsylvania Department of Labor’s guidelines can provide important information. They help you to understand the settlement process, ensuring you receive fair compensation for your injuries.

How Do I Use The Workers’ Comp Settlement Calculator?

The calculator estimates your claim’s lump sum value based on the information you plug in. Based on your information, it gives a starting point for a conversation with a lawyer. It cannot replace legal advice from an experienced workers’ comp lawyer.

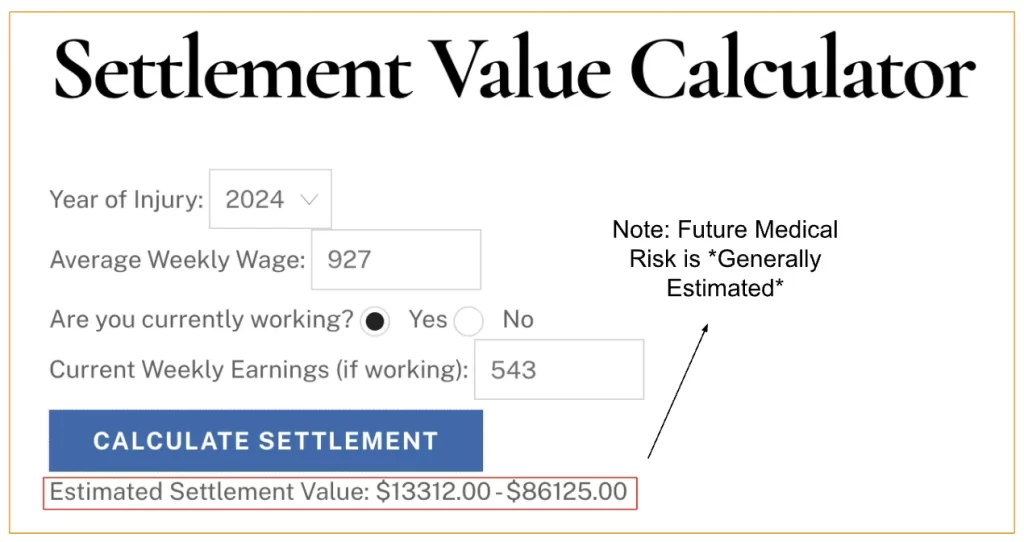

- Enter the year of your date of injury (2022-2024). Since rates change each year, this helps give a better estimate of the true value.

- Enter your average weekly wage. Use our guide and calculator to estimate if you need help. Give an accurate number to get a closer estimate.

- Select whether or not you are currently working. Benefits change when you work, so it needs to know.

- If you are working, enter your current weekly earnings. This helps calculate the benefit rate owed while working.

- Click “Calculate Settlement” to see your case value estimate. The crucial term in this context is “estimate.” Make sure you talk to a lawyer before making any decisions based on this number.

Example Settlement Estimate

Below you will find an example of a settlement value range based on the information entered. Our formula automatically calculates this range.

Conclusion

This calculator serves as a useful tool to help you get an idea of the value of your case. It can only give you an estimate and does not replace the need for a lawyer. Many factors can affect the value of your case.

Call our office 24/7 for a free consultation and free case evaluation at (215) 609-4183. We look forward to getting you the money that you deserve.