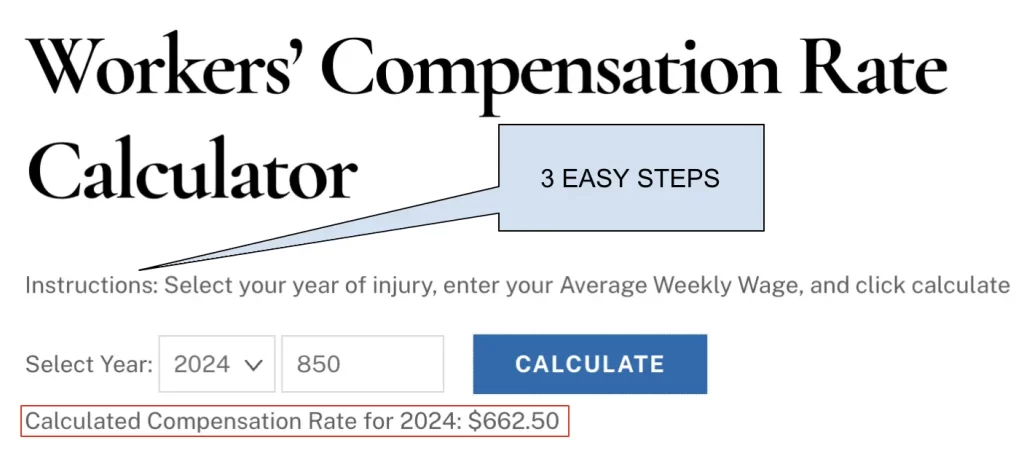

Pennsylvania Workers’ Compensation Rate Calculator

Workers’ Compensation Rate Calculator

Instructions: Select your year of injury, enter your Average Weekly Wage, and click calculate

2024 Workers' Compensation Rates & Average Weekly Wage

See Updated Post For 2025-2026 Workers Compensation Claims

The Bureau of Labor & Industry has given an update on the average weekly wage for 2024. Section 105.1 of the Workers’ Compensation Act requires this update every year. You can use our free calculator to get your compensation rate based on your wages.

The 2024 Statewide Average Weekly Wage

Starting January 1, 2024, the statewide average weekly wage (AWW) for work injuries occurring in 2024 stands at $1,325.00, marking a 4% increase from 2023.

Injured workers can receive workers’ comp for lost wages and medical expenses. Typically, wage loss benefits total 2/3 of the regular pay (Average Weekly Wage), but not always.

To calculate your AWW, fill out the Statement of Wages form LIBC-494C provided by the Bureau. To estimate your AWW, use the average amount of your weekly pay (before taxes and deductions).

How To Calculate The Average Weekly Wage

The Average Weekly Wage (AWW) includes all wages, from all jobs, where the employee worked at the time of injury.

Combining all wages to determine the AWW ensures the compensation reflects the total earning potential lost. This makes the workers’ compensation calculation much more accurate.

Several things play a role in what counts towards the AWW. This includes wage rates, overtime pay, bonuses, vacation pay, and board and lodging if provided by the employer. Tips also count, as long as they appear on federal income tax returns. Additionally, certain types of supplemental unemployment benefits, typically coming from services performed, can factor into the AWW.

For seasonal employees, the calculation takes a unique form. The AWW typically accounts for 2% of total earnings from all jobs in the previous year (seasonally adjusted). This takes into account the fluctuating nature of seasonal work.

For salaried employees, divide the annual salary by 52 weeks to find your average weekly wage.

Exclusions From The AWW

Specific exclusions apply to the AWW calculation. Some fringe benefits, like employer contributions to health insurance or retirement plans, do not count toward the AWW. The same applies to unemployment benefits and non-monetary compensation, except for board and lodging. Earnings from independent contractor work generally do not count either.

Special rules apply to certain groups of workers. Volunteer emergency workers, for example, have an additional presumption regarding their earnings, even if unemployed. Teachers under annual contracts and workers with specific loss injuries also face unique guidelines that affect their AWW calculations. For more information on these different class codes and their risk, reach out to a workers’ comp lawyer.

Workers’ Comp Benefit Amounts Explained

The Workers’ Compensation Act provides the compensation formula for wage replacement based on weekly rates. We calculate your benefit rate based on the guidelines in the Act using a percentage of the AWW. However, compensation, by law, cannot exceed the statewide average weekly wage in the year of the injury. While you may find that your comp rate seems low, note that workers’ comp benefits are not taxable.

@thwesq Replying to @angieGelos123 wage loss benefits in workers’ comp aren’t always that simple, but it’s a percentage of the average weekly wage to account for taxes and other deductions from pay that dont come out of workers compensation. It isnt perfect (take home money here in PA hovers between 70-80% for most people) #workersrights #workerscomp #lawyer #lawyersontiktok ♬ original sound – Tom Wing

Disability Benefits

If a worker suffers total disability, meaning they are out of work completely, they will receive their full comp rate. When a worker cannot work full time, but has some income, the disability qualifies as partial. In this instance, they would receive 2/3 of the difference between the average weekly wage and their current earnings.

Also remember, the number of days that you miss work matter. No disability compensation becomes due if wage loss lasts for less than 7 days. Disability payments would start on day 8 if wage loss exceeds 7 days. Once wage loss hits 14 days or more, all the disability is payable, including the first 7 days.

How To Calculate Workers’ Compensation Benefit

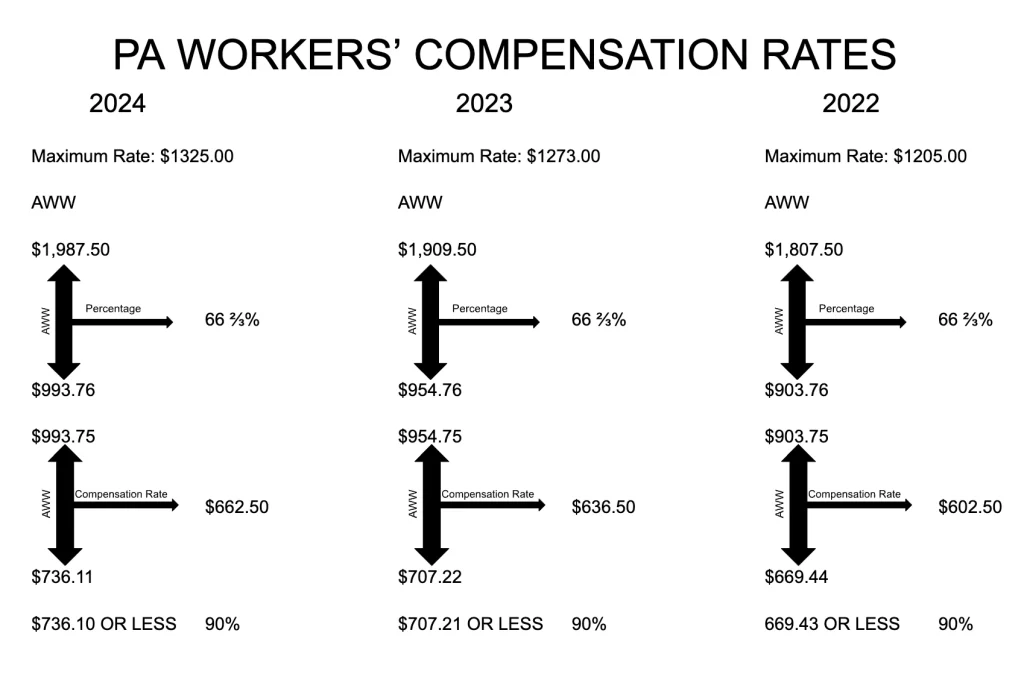

This graphic shows how to calculate your PA workers’ comp benefit rate based on your AWW for injuries that occurred from 2022 through 2024. Remember, the maximum weekly compensation rate equals the statewide AWW for your year of injury.

This graphic outlines the compensation rates based on the worker’s average weekly wage. To use this graphic properly, you must use the year of your date of injury or illness for the calculation.

For example, a worker injured in 2024 with an average weekly wage of $900.00 would have a comp rate of $662.50 per week. Or, if a worker had an average weekly wage of $1,200.00 per week, they would receive 66 2/3 percent ($800.00) in compensation.

You receive either a flat rate in workers comp’ or a percentage of your AWW. You can also use the calculator above to calculate your benefit rate for a work related injury from 2022-2024.

Conclusion

Whether you have worked for a small business or a large corporation, work injuries can change your world. When facing a number of weeks out of work, injured workers often find themselves in stressful situations. Workers’ compensation insurance benefits cover medical treatment and wage loss for injured workers, helping to ease this stress.

The AWW and compensation rate calculations can present some challenges. By familiarizing yourself with the basics, you better prepare yourself for what to expect with a work injury.

If you have questions about your compensation rate or need any help with your claim, let us know. Reach out to our offices 24/7 for a free and confidential consultation (215) 609-4183. We have experienced workers’ compensation lawyers ready to assist you today.